Australia’s e-commerce logistics market is projected to exceed AUD 18 billion by 2026. That figure tells only part of the story. Behind it sits a fulfilment infrastructure under mounting pressure — one where manual warehouse operations are struggling to keep pace with surging online demand.

For retailers, wholesalers, and third-party logistics providers, SmartlogitecX warehouse automation has moved beyond competitive advantage. It is now a strategic necessity. The gap between automated and non-automated operations is widening in measurable ways: throughput, accuracy, cost-per-order, and customer retention.

This article examines the core technologies driving smart warehousing, the business case for investment, how Australian retailers are already deploying these systems, and the practical considerations for businesses ready to act. Whether you operate a high-volume distribution centre or a growing mid-market fulfilment operation, the principles here apply. SmartlogitecX has been tracking these shifts closely — and the trajectory is clear.

Why Australian E-Commerce Demands Warehouse Automation

The E-Commerce Fulfilment Challenge Facing Australian Warehouses

Australian consumers spent over $63 billion online in 2023, according to Australia Post data. More than 70% of Australian businesses now generate some form of online revenue. That volume creates a compounding problem for warehouse operators still reliant on manual pick-and-pack workflows.

Traditional warehouses were designed for bulk distribution, not the item-level complexity of e-commerce. When seasonal peaks — Black Friday, Click Frenzy, end-of-financial-year sales — collide with baseline growth, manual operations buckle. Orders stack up. Errors multiply. Dispatch windows shrink.

How Delivery Speed Expectations Shape Customer Loyalty

Consumer expectations have hardened. Research from PwC found that 41% of Australian shoppers would abandon a brand after a single poor delivery experience. Same-day and next-day fulfilment are no longer premium features. They are baseline expectations for a growing segment of online buyers.

The only way to meet these expectations at scale — without spiralling labour costs — is to compress the time between order receipt and dispatch. That compression is precisely what warehouse automation delivers.

Key Warehouse Automation Technologies Powering E-Commerce

Autonomous Mobile Robots and Goods-to-Person Systems

Autonomous mobile robots (AMRs) use geo-navigation to move through warehouse aisles, retrieve inventory, and deliver items directly to pick stations. The operator stays stationary. The product comes to them.

This reversal of traditional picking workflows is significant. Studies from the Material Handling Institute show goods-to-person systems can increase pick rates by 200–300% compared to manual methods. AMRs are also modular — they can be deployed incrementally without redesigning the entire warehouse footprint.

Robotic Picking, Sortation, and Machine Vision

Robotic picking cells equipped with machine vision can recognise and handle packages of varying shapes, sizes, and weights. These systems operate continuously, reducing bottlenecks at pick stations during peak periods.

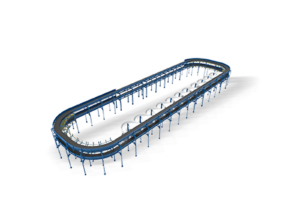

SmartlogitecX automated sortation — using cross-belt and pop-wheel systems — routes parcels to the correct dispatch lane at high speed. In large-scale fulfilment centres, sortation alone can handle thousands of units per hour with near-zero misroute rates.

AI-Powered Warehouse Management Systems

The technologies above generate value only when orchestrated effectively. AI-driven warehouse management systems (WMS) provide that orchestration — coordinating demand forecasting, inventory optimisation, real-time tracking, and intra-warehouse route planning from a single platform.

SmartlogitecX integrates these WMS capabilities with physical automation systems, ensuring that data flows between robots, sortation lines, and human operators without friction. The result is a warehouse that thinks as well as it moves.

Business Benefits: ROI and Competitive Advantage of Warehouse Automation

Productivity Gains and Revenue Per Square Foot

McKinsey research indicates that warehouse automation can increase revenue per square foot by 10–20%. Throughput improvements compound over time as systems learn operational patterns and optimise accordingly.

Error rates drop measurably. Manual pick-and-pack error rates typically sit between 1–3%. Automated systems routinely achieve 99.9% accuracy. For high-volume operations, that difference translates to fewer returns, fewer customer complaints, and stronger margins.

Workforce Augmentation, Not Replacement

The automation-replaces-jobs narrative is persistent but misleading. What automation replaces are repetitive, physically demanding tasks — the kind that drive high injury rates and workforce turnover in traditional warehouses.

In their place, automation creates skilled roles in robotics operation, system maintenance, data analysis, and process engineering. The workforce shifts upward, not outward. Australia’s tight labour market makes this rebalancing especially relevant.

How Australian Retailers Are Adopting Warehouse Automation

Major Retailers Leading the Charge

Woolworths invested heavily in its Moorebank Logistics Park in western Sydney, deploying automated distribution centres designed to service both store replenishment and direct-to-customer fulfilment. Coles followed with Witron-powered automated fulfilment centres in Queensland and New South Wales. Amazon continues to expand its Australian fulfilment network with robotics-driven facilities across multiple states.

These investments signal a clear direction. The largest players in Australian retail have placed long-term bets on automation — and their supply chain performance reflects it.

SMEs and Mid-Market Opportunities

Automation is no longer the exclusive domain of billion-dollar retailers. Modular goods-to-person systems and robotics-as-a-service models have lowered the entry barrier for mid-market operators.

Booktopia’s investment in warehouse robotics demonstrated that even specialist online retailers can achieve meaningful efficiency gains through targeted automation. The capital outlay is smaller. The payback period is shorter. And the operational impact is immediate.

Getting Started with Warehouse Automation: Key Implementation Considerations

Assessing Your Operational Readiness

Before selecting any technology, audit your current bottlenecks. Where do delays occur? Where do errors concentrate? What does your order volume look like across peak and baseline periods?

Map your product mix, storage requirements, and growth projections against the capabilities of available systems. Automation works best when it is targeted at specific pain points — not deployed as a blanket solution.

Choosing the Right Automation Partner

The partner you select matters as much as the technology itself. Look for local market expertise, proven deployment capability, and integrated WMS solutions that connect hardware to data.

SmartlogitecX works with Australian businesses across this spectrum — from initial operational assessment through to full system integration and ongoing optimisation. The right partner treats automation as a strategic programme, not a one-off procurement exercise.

Frequently Asked Questions

1. What is warehouse automation?

Warehouse automation refers to the use of technology — including robotics, AI-powered software, and conveyor systems — to perform warehousing tasks that were previously handled manually. This includes picking, packing, sorting, and inventory management.

2. How much does warehouse automation cost in Australia?

Costs vary significantly depending on the scale and type of automation. Modular AMR systems can start from $500,000 for mid-sized operations, while enterprise-level fully automated distribution centres can exceed $50 million. Robotics-as-a-service models offer lower upfront costs.

3. What are the most common warehouse automation technologies?

The most widely adopted technologies include autonomous mobile robots (AMRs), goods-to-person systems, robotic picking arms with machine vision, automated sortation systems, and AI-driven warehouse management systems.

4. Can small businesses benefit from warehouse automation?

Yes. Modular and scalable solutions now make automation accessible to SMEs and mid-market operators. Goods-to-person systems and robotics-as-a-service models reduce capital outlay while delivering measurable efficiency gains.

5. Will warehouse automation eliminate jobs?

Automation reshapes roles rather than eliminating them. Repetitive manual tasks are automated, while new skilled positions emerge in robotics operation, system maintenance, and data analysis.

6. How long does it take to implement warehouse automation?

Timelines range from three to six months for modular robotic systems to 18–24 months for fully automated distribution centre buildouts. Phased implementations allow operations to continue during deployment.

7. What ROI can Australian businesses expect from warehouse automation?

Research suggests automation can increase revenue per square foot by 10–20%, reduce pick error rates to below 0.1%, and significantly lower cost-per-order over a three to five-year horizon.

8. How do I know if my warehouse is ready for automation?

Start by auditing current bottlenecks, order volumes, product mix complexity, and growth projections. A readiness assessment identifies where automation will deliver the most immediate impact.

9. What should I look for in a warehouse automation partner?

Prioritise local market expertise, proven deployment experience, integrated WMS capabilities, and the ability to support phased implementation. SmartlogitecX offers end-to-end support across assessment, integration, and ongoing optimisation.

Warehouse Automation Is a Strategic Imperative — Not a Future Aspiration

The technologies are proven. The ROI is measurable. And the competitive gap between automated and non-automated warehouse operations in Australia is widening every quarter.

From AMRs and machine vision to AI-driven warehouse management, the tools exist to transform fulfilment speed, accuracy, and cost efficiency. Major Australian retailers have already committed. Mid-market operators are following.

The question is no longer whether to automate. It is when — and with whom. SmartlogitecX partners with Australian businesses to navigate that decision, from operational assessment through to full-scale implementation. If your warehouse is still running on manual processes, the time to evaluate your options is now.span style=”font-weight: 400;”>Australia’s e-commerce logistics market is projected to exceed AUD 18 billion by 2026. That figure tells only part of the story. Behind it sits a fulfilment infrastructure under mounting pressure — one where manual warehouse operations are struggling to keep pace with surging online demand.

For retailers, wholesalers, and third-party logistics providers, warehouse automation has moved beyond competitive advantage. It is now a strategic necessity. The gap between automated and non-automated operations is widening in measurable ways: throughput, accuracy, cost-per-order, and customer retention.

This article examines the core technologies driving smart warehousing, the business case for investment, how Australian retailers are already deploying these systems, and the practical considerations for businesses ready to act. Whether you operate a high-volume distribution centre or a growing mid-market fulfilment operation, the principles here apply. SmartlogitecX has been tracking these shifts closely — and the trajectory is clear.

Why Australian E-Commerce Demands Warehouse Automation

The E-Commerce Fulfilment Challenge Facing Australian Warehouses

Australian consumers spent over $63 billion online in 2023, according to Australia Post data. More than 70% of Australian businesses now generate some form of online revenue. That volume creates a compounding problem for warehouse operators still reliant on manual pick-and-pack workflows.

Traditional warehouses were designed for bulk distribution, not the item-level complexity of e-commerce. When seasonal peaks — Black Friday, Click Frenzy, end-of-financial-year sales — collide with baseline growth, manual operations buckle. Orders stack up. Errors multiply. Dispatch windows shrink.

How Delivery Speed Expectations Shape Customer Loyalty

Consumer expectations have hardened. Research from PwC found that 41% of Australian shoppers would abandon a brand after a single poor delivery experience. Same-day and next-day fulfilment are no longer premium features. They are baseline expectations for a growing segment of online buyers.

The only way to meet these expectations at scale — without spiralling labour costs — is to compress the time between order receipt and dispatch. That compression is precisely what warehouse automation delivers.

Key Warehouse Automation Technologies Powering E-Commerce

Autonomous Mobile Robots and Goods-to-Person Systems

Autonomous mobile robots (AMRs) use geo-navigation to move through warehouse aisles, retrieve inventory, and deliver items directly to pick stations. The operator stays stationary. The product comes to them.

This reversal of traditional picking workflows is significant. Studies from the Material Handling Institute show goods-to-person systems can increase pick rates by 200–300% compared to manual methods. AMRs are also modular — they can be deployed incrementally without redesigning the entire warehouse footprint.

Robotic Picking, Sortation, and Machine Vision

Robotic picking cells equipped with machine vision can recognise and handle packages of varying shapes, sizes, and weights. These systems operate continuously, reducing bottlenecks at pick stations during peak periods.

Automated sortation — using cross-belt and pop-wheel systems — routes parcels to the correct dispatch lane at high speed. In large-scale fulfilment centres, sortation alone can handle thousands of units per hour with near-zero misroute rates.

AI-Powered Warehouse Management Systems

The technologies above generate value only when orchestrated effectively. AI-driven warehouse management systems (WMS) provide that orchestration — coordinating demand forecasting, inventory optimisation, real-time tracking, and intra-warehouse route planning from a single platform.

SmartlogitecX integrates these WMS capabilities with physical automation systems, ensuring that data flows between robots, sortation lines, and human operators without friction. The result is a warehouse that thinks as well as it moves.

Business Benefits: ROI and Competitive Advantage of Warehouse Automation

Productivity Gains and Revenue Per Square Foot

McKinsey research indicates that warehouse automation can increase revenue per square foot by 10–20%. Throughput improvements compound over time as systems learn operational patterns and optimise accordingly.

Error rates drop measurably. Manual pick-and-pack error rates typically sit between 1–3%. Automated systems routinely achieve 99.9% accuracy. For high-volume operations, that difference translates to fewer returns, fewer customer complaints, and stronger margins.

Workforce Augmentation, Not Replacement

The automation-replaces-jobs narrative is persistent but misleading. What automation replaces are repetitive, physically demanding tasks — the kind that drive high injury rates and workforce turnover in traditional warehouses.

In their place, automation creates skilled roles in robotics operation, system maintenance, data analysis, and process engineering. The workforce shifts upward, not outward. Australia’s tight labour market makes this rebalancing especially relevant.

How Australian Retailers Are Adopting Warehouse Automation

Major Retailers Leading the Charge

Woolworths invested heavily in its Moorebank Logistics Park in western Sydney, deploying automated distribution centres designed to service both store replenishment and direct-to-customer fulfilment. Coles followed with Witron-powered automated fulfilment centres in Queensland and New South Wales. Amazon continues to expand its Australian fulfilment network with robotics-driven facilities across multiple states.

These investments signal a clear direction. The largest players in Australian retail have placed long-term bets on automation — and their supply chain performance reflects it.

SMEs and Mid-Market Opportunities

Automation is no longer the exclusive domain of billion-dollar retailers. Modular goods-to-person systems and robotics-as-a-service models have lowered the entry barrier for mid-market operators.

Booktopia’s investment in warehouse robotics demonstrated that even specialist online retailers can achieve meaningful efficiency gains through targeted automation. The capital outlay is smaller. The payback period is shorter. And the operational impact is immediate.

Getting Started with Warehouse Automation: Key Implementation Considerations

Assessing Your Operational Readiness

Before selecting any technology, audit your current bottlenecks. Where do delays occur? Where do errors concentrate? What does your order volume look like across peak and baseline periods?

Map your product mix, storage requirements, and growth projections against the capabilities of available systems. Automation works best when it is targeted at specific pain points — not deployed as a blanket solution.

Choosing the Right Automation Partner

The partner you select matters as much as the technology itself. Look for local market expertise, proven deployment capability, and integrated WMS solutions that connect hardware to data.

SmartlogitecX works with Australian businesses across this spectrum — from initial operational assessment through to full system integration and ongoing optimisation. The right partner treats automation as a strategic programme, not a one-off procurement exercise.

Frequently Asked Questions

1. What is warehouse automation?

Warehouse automation refers to the use of technology — including robotics, AI-powered software, and conveyor systems — to perform warehousing tasks that were previously handled manually. This includes picking, packing, sorting, and inventory management.

2. How much does warehouse automation cost in Australia?

Costs vary significantly depending on the scale and type of automation. Modular AMR systems can start from $500,000 for mid-sized operations, while enterprise-level fully automated distribution centres can exceed $50 million. Robotics-as-a-service models offer lower upfront costs.

3. What are the most common warehouse automation technologies?

The most widely adopted technologies include autonomous mobile robots (AMRs), goods-to-person systems, robotic picking arms with machine vision, automated sortation systems, and AI-driven warehouse management systems.

4. Can small businesses benefit from warehouse automation?

Yes. Modular and scalable solutions now make automation accessible to SMEs and mid-market operators. Goods-to-person systems and robotics-as-a-service models reduce capital outlay while delivering measurable efficiency gains.

5. Will warehouse automation eliminate jobs?

Automation reshapes roles rather than eliminating them. Repetitive manual tasks are automated, while new skilled positions emerge in robotics operation, system maintenance, and data analysis.

6. How long does it take to implement warehouse automation?

Timelines range from three to six months for modular robotic systems to 18–24 months for fully automated distribution centre buildouts. Phased implementations allow operations to continue during deployment.

7. What ROI can Australian businesses expect from warehouse automation?

Research suggests automation can increase revenue per square foot by 10–20%, reduce pick error rates to below 0.1%, and significantly lower cost-per-order over a three to five-year horizon.

8. How do I know if my warehouse is ready for automation?

Start by auditing current bottlenecks, order volumes, product mix complexity, and growth projections. A readiness assessment identifies where automation will deliver the most immediate impact.

9. What should I look for in a warehouse automation partner?

Prioritise local market expertise, proven deployment experience, integrated WMS capabilities, and the ability to support phased implementation. SmartlogitecX offers end-to-end support across assessment, integration, and ongoing optimisation.

Warehouse Automation Is a Strategic Imperative — Not a Future Aspiration

The technologies are proven. The ROI is measurable. And the competitive gap between automated and non-automated warehouse operations in Australia is widening every quarter.

From AMRs and machine vision to AI-driven warehouse management, the tools exist to transform fulfilment speed, accuracy, and cost efficiency. Major Australian retailers have already committed. Mid-market operators are following.

The question is no longer whether to automate. It is when — and with whom. SmartlogitecX partners with Australian businesses to navigate that decision, from operational assessment through to full-scale implementation. If your warehouse is still running on manual processes, the time to evaluate your options is now.